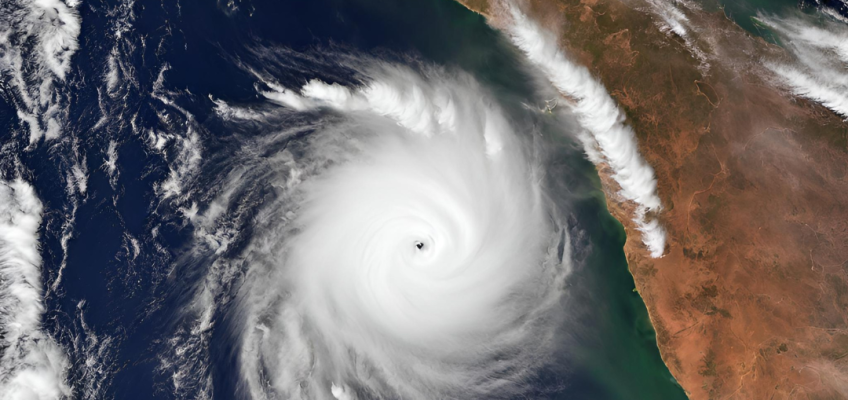

A tropical low south of Christmas Island is expected to track close to WA later this week and has a high chance of developing into a cyclone, the Bureau of Meteorology has warned.

The tropical low will approach the Western Australian mainland later in the week and is expected to develop into a tropical cyclone as it approaches the coast. The most likely scenario is that it may remain offshore, but due to its proximity to the coast, there could be possible impacts along the Pilbara coast on the weekend.

The system west of Australia in the Indian Ocean may bring strong to gale force winds at Christmas Island today as it travels east-southeast towards the mainland.

For those planning to travel to the affected area, it is highly advisable to stay informed with the latest updates from reliable news sources or refer to Australia’s official weather forecasts and weather radar provided by the Bureau of Meteorology (bom.gov.au)

For Single Trip policies purchased prior to 6:00pm AEST on 12 March 2024 and trips booked under Annual Multi Trip policies prior 6:00pm AEST on 12 March 2024.

Disruption experienced post-departure.

Claims for disruption to scheduled travel arrangements post-departure are considered under Section 1 or Section 10.

To claim under Section 1, your policy must include the Cancellation and Curtailment module. To claim under Section 10, your policy must include the Disruption module.

Subject to relevant terms and conditions, Section 1 will compensate the Insured Person for additional travel expenses incurred (and a proportionate refund of unused arrangements) if a natural disaster prevents the planned travel from occurring.

Subject to relevant terms and conditions, Section 10 provides financial assistance in the event the departure of public transport on which the Insured Person is booked to travel is delayed by at least 12 hours. Section 10 does not operate if the Insured Person has claimed under Section 1 or 12 (Special Events) in relation to the same cause.

All Insured Persons must act as a “prudent uninsured” and proceed on the most economical basis to minimise their loss. We therefore suggest in the first instance they liaise with airlines and associated travel providers to reschedule travel arrangements / obtain refunds as appropriate. Some airlines will provide accommodation to passengers whose travel is disrupted due to natural disasters and policyholders should avail themselves of this facility if possible.

All claims for additional accommodation and travel expenses must be supported by receipts, evidence of pre-booked travel schedule and actual travel arrangements.

If this event determines that you cannot return home as scheduled, your policy will provide a 21-day automatic extension. This means that if you cannot return home due to circumstances outside your control, your policy will remain in place for up to a further 21 days without payment of additional premium. You don’t need to contact us to request a policy extension – this is an automatic provision.

Disruption experienced pre-departure.

If you have not yet departed on the trip and your outbound flight arrangements are cancelled due to:

- Natural disaster preventing the booked travel occurring as planned.

- Delayed departure of the initial outbound flight beyond 12 hours; or

- DFAT issuing a travel warning advising against travel to the affected region and which remains in force 7 days prior to scheduled travel.

There is provision within the policy for amendment costs or reimbursement of irrecoverable payments made in the event of total cancellation (Section 1).

In this case, Section 1 provides to cover the cost incurred to amend the policyholder’s travel to a later date / alternate route OR the cost of forfeited pre-booked travel arrangements if the trip is cancelled (whichever is the lesser). If a policyholder’s travel is affected, we retain the option to decide which of these options will be used as the basis for determining policy response.

Many airlines will offer full refunds or rescheduling at no cost in the event of cancellation due to natural disasters and we would recommend policyholders liaise with the airline/s, travel agent/s and associated travel providers to minimise any loss / claim.

For Single Trip and Multi Trip policies purchased on or after 6:01pm AEST on 12 March 2024

Insurance serves to provide cover for sudden and unforeseen risks. It is not possible to insure against known risks and the policy specifically excludes claims resulting from circumstances known at the time of policy purchase or trip booking and which could reasonably be expected to give rise to a claim.

Whilst this advice details a preliminary assessment of potential policy response, it is anticipated that no cover will be afforded for any claim arising from this forecasted event for policies purchased on or after 6:01pm AEST on 12 March 2024, or trips booked under an Annual Multi Trip policy on or after 6:01pm AEST on 12 March 2024.

GENERAL NOTE:

Please remember that no two claims are the same and accordingly, claims are assessed on a case-by-case basis. This advice is of a general nature.

Claims are assessed on a case-by-case basis, subject to the terms and conditions of the PDS in force at the time of policy purchase.

Policyholders are advised to stay updated with travel-related entities, and the claims team is available for assistance.

Please contact us if you require further assistance.